A U.S. judge has determined Coinbase’s self-custody crypto wallet doesn’t make it a broker, which lawyers say is a “significant setback” for the SEC and a boon for DeFi.

Crypto lawyers are hailing a recent decision by a United States judge to dismiss allegations against Coinbase Wallet as a win for self-custody wallets and decentralized finance (DeFi) apps.

U.S. District Judge Katherine Failla on March 27 denied Coinbase’s bid to dismiss a Securities and Exchange Commission’s lawsuit, finding the SEC “sufficiently pleaded” Coinbase was unlicensed and its crypto staking offering was unregistered securities.

The judge also determined the SEC failed to allege that Coinbase conducted brokerage activity through Coinbase Wallet — its self-custody crypto wallet app giving users full control of their assets.

“[This] is a pretty giant win for browser-based wallet extensions, application front ends, and other similar applications,” said Ethena Labs general counsel Zach Rosenberg in a March 27 X post.

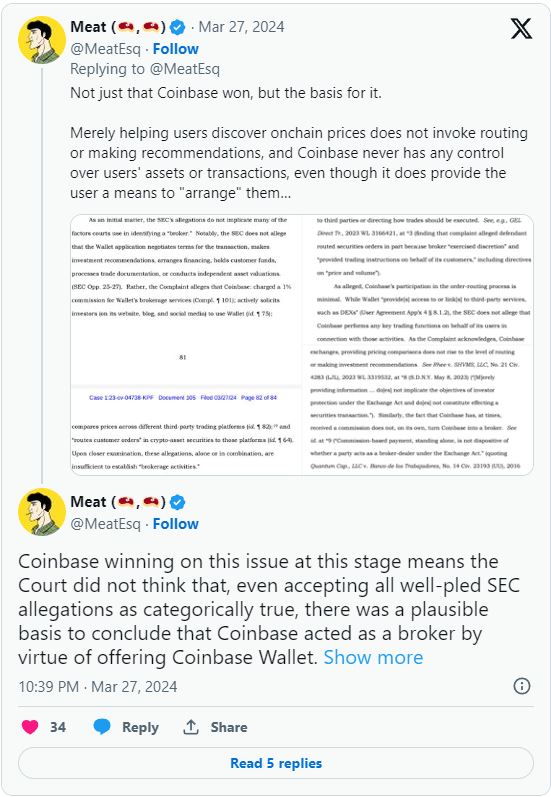

“[It’s] not just that Coinbase won, but the basis for it,” Rosenberg emphasized. He explained that Coinbase helping Wallet users find token prices doesn’t mean it’s acting as a broker by “routing or making recommendations.”

The court order could be used by DeFi app developers facing similar lawsuits to argue their way out of allegations they acted as an unregistered broker.

Industry advocate body the Blockchain Association legal head Marisa Tashman Coppel posted she was “very pleased to see the court curb massive SEC overreach with regard to the Coinbase Wallet allegations.”

Law firm Willkie Farr & Gallagher partner Mike Selig said in an X post the Coinbase Wallet dismissal was a “significant setback” for the SEC.

Crypto venture firm Variant legal chief Jake Chervinsky said, however, that while there are “some positives” in the judge’s order — “overall, SEC wins.”

“It’s great for DeFi that Wallet is not a broker, and there’s good language on other issues,” he said. “But the court sided with the SEC (incorrectly, [in my opinion]) on several key issues.”

Chervinsky explained Judge Failla said the Howey test — a legal framework to classify securities — applies to “purely secondary market transactions” and ignores the “‘contract’ in ‘investment contract.’”

He claimed the court also adopted the SEC’s theory that a token project using sale profits to re-invest into its ecosystem is a “common enterprise” where buyers would reasonably expect profits — making it a security.

“This is a disappointing outcome,” Chervinsky said. “But it’s only the beginning — not the end — of the SEC’s case against Coinbase specifically.”

The case will now continue into discovery — where Coinbase and the SEC collect evidence for their arguments.

The SEC first sued Coinbase in June last year, alleging it listed 13 tokens the regulator deemed securities and operated as an unlicenced exchange and broker-dealer, which Coinbase denies.